Verde Chico

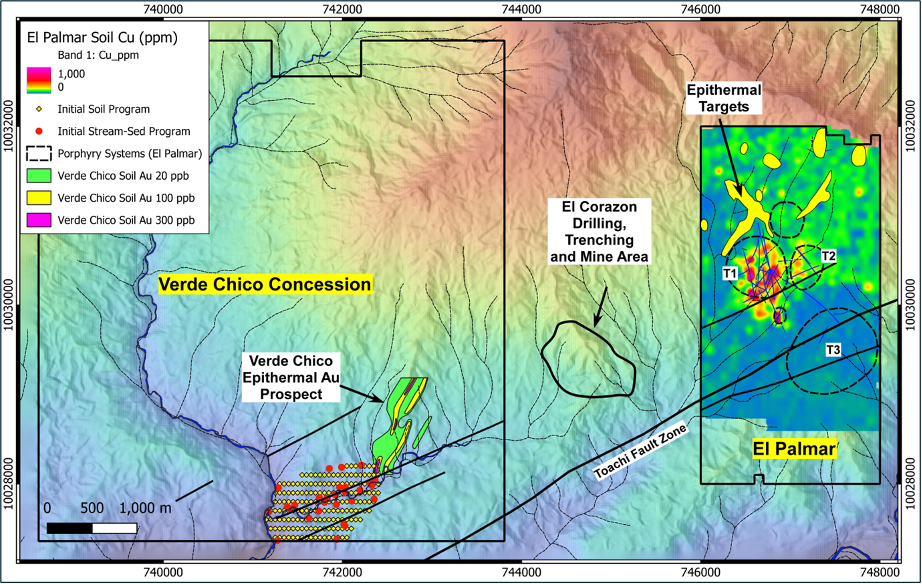

Verde Chico is located to the west of Sunstone’s El Palmar gold-copper porphyry discovery and quadruples Sunstone’s land position in this prospective belt in northern Ecuador to 3,672ha.

There is geological potential to define both porphyry copper-gold and epithermal gold opportunities

The Verde Chico project was explored by the Rio Tinto group (then called RTZ) in 1992-1995, and by Canadian junior Balaclava Mines in 1998. No exploration has been undertaken on the land since 1998. The historical exploration identified a 1.1km-long gold-in-soil anomaly that is open to the north and south, and which includes several high-grade gold-bearing veins at surface and wide lower grade zones of gold mineralisation in some drill holes. A total of 12 trenches for 683m were opened and sampled following mineralised structures. A total of 28 drill holes for 4,436m were drilled by RTZ and Balaclava. The area of initial effective exploration only covers approximately 10% of the concession (Figure 2).

Historical exploration comprised regional stream sediment sampling, soil sampling, limited geophysics (CSAMT), trench sampling, and diamond drilling. The soil sampling by Rio Tinto defined a >1.1km long gold-in-soil anomaly (Figure 3), coincident with a CSAMT resistivity anomaly. This area was drilled at several locations (Figure 3) and returned significant intervals of gold mineralisation including 68.5m at 1.05g/t gold from surface in hole RVC-08, including 1m at 11.3g/t gold from 40.5m.

Exploration at Verde Chico has commenced with initial follow-up to the known high-grade gold mineralisation

Historical exploration from the 1990’s includes:

- Perdida vein - 6.5m @ 25.11 g/t Au

- Peligrosa vein - 24m @ 21.2 g/t Au, 19m @ 7.72 g/t Au, 25m @ 10.24 g/t Au

- Gato vein - 39m @ 3.08 g/t Au

- avas vein - 26.5 @ 2.28 g/t Au, 10m @ 11.72 g/t Au

- Oso Hormiguero vein - 29m @ 8.26 g/t Au, 11m @ 9.08 g/t Au

- Falla vein - 8m @ 7.28 g/t Au

STAGED ACQUISITION AGREEMENT TERMS

The Staged Acquisition Agreement between Sunstone and the vendors whereby Sunstone will ultimately own 100% of the property.

- Verde Chico Group (VCG) has agreed to transfer the Concession to MinVCH (‘COMPAÑÍA MINERA VERDE CHICO MINVERDECHICO CIA. LTDA.’ a new entity which will hold the Verde Chico concession)

- Staged Acquisition Agreement between Sunstone, VCG, and MinVCH whereby Sunstone will ultimately own 100% of MinVCH

- Cash payments to VCG linked to specific time frames and milestones

- At commencement of drilling a payment of $100,000

- Up to 1 year after start of drilling a payment of $150, 000 at which time a 25% equity interest in MinVCH will be transferred to Sunstone

- Up to 2 years after start of drilling a payment of $250,000 + $50,000 in Sunstone shares (subject to any required shareholder approval to satisfy ASX) and Sunstone receives additional 26% equity, taking its ownership in MinVCH to 51%

- Within 4 years of Sunstone holding 51% equity in MinVCH make a payment of $1,500,000 + $300,000 in Sunstone shares (subject to any required shareholder approval to satisfy ASX), and Sunstone receives an additional 34% equity, taking its ownership in MinVCH to 85%

- Within 1 year of Sunstone holding 85% equity in MinVCH making a payment of $1,500,000 and make a one-off inaugural Mineral Resource Estimate linked payment of 1/1000 of the current value of each ounce of gold equivalent estimated within the Measured and Indicated Resources in the inaugural Mineral Resource Estimate up to a maximum payment of $3,000,000. Sunstone receives additional 15% equity taking its equity to 100% of MinVCH.

- An ongoing 1% NSR royalty from production, with a buyback option to Sunstone of ¾ for the NSR royalty for $1,000,000.