Overview

CLICK LINK to see the Oct-24 ASX El Palmar Mineral Resource and Exploration Target

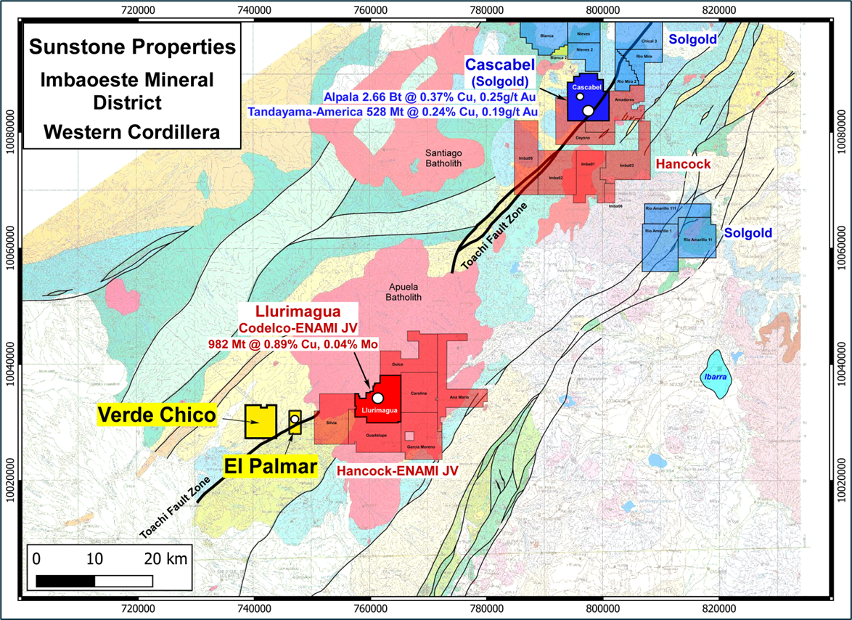

El Palmar is located in a highly prospective mineralised district related to the Toachi Faults Zone. These Tier 1 regional deposits include:

- 2.7Bt Alpala copper-gold porphyry deposit (0.53% CuEq) at Cascabel

- 0.53Bt Tanayama-America copper-gold porphyry deposit (0.36% CuEq at Cascabel)

- 1Bt Llurimagua copper-moly porphyry deposit (1.0% CuEq)

The prodigious nature of this district is further emphasised by Hancock Prospecting investing $US120m to earn into JV with state-owned ENAMI in northern Ecuador (adjacent to El Palmar).

At El Palmar in northern Ecuador, Sunstone has established to date:

- A maiden Mineral Resource estimate (MRE) of 1.2Moz AuEq

- A gold and copper Exploration Target of 15M - 45Moz AuEq

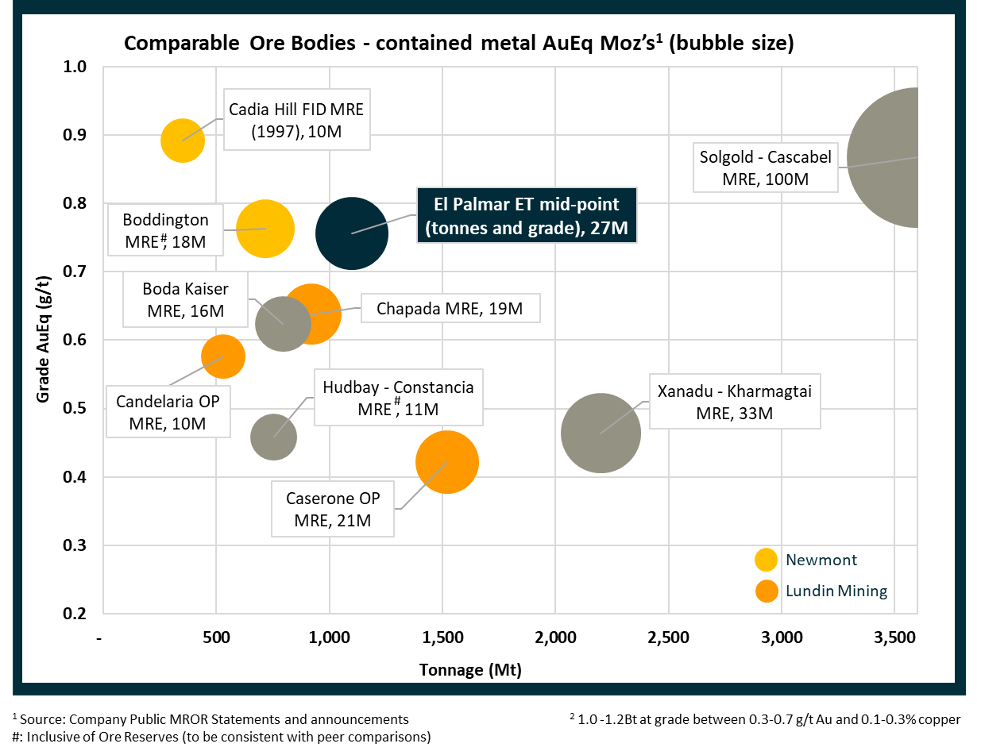

The El Palmar 15M – 45M oz AuEq Exploration Target demonstrates the potential for El Palmar to rank alongside Tier 1 global gold-copper mines.

The El Palmar exploration target (mid-point of tonnes and grade) compares favourably with two of Australia’s premier mines (owned by Newmont) and Lundin Mining’s three South American flagship mines.

The “Porphyry grades” of these comparable mines are economically attractive because of:

- Bulk mining/processing at scale

- Low strip ratios

- Lower input costs in the host jurisdiction (Ecuador has a major strategic advance for both energy and labour costs)